The better way to invest in Crypto

LIVA Fund

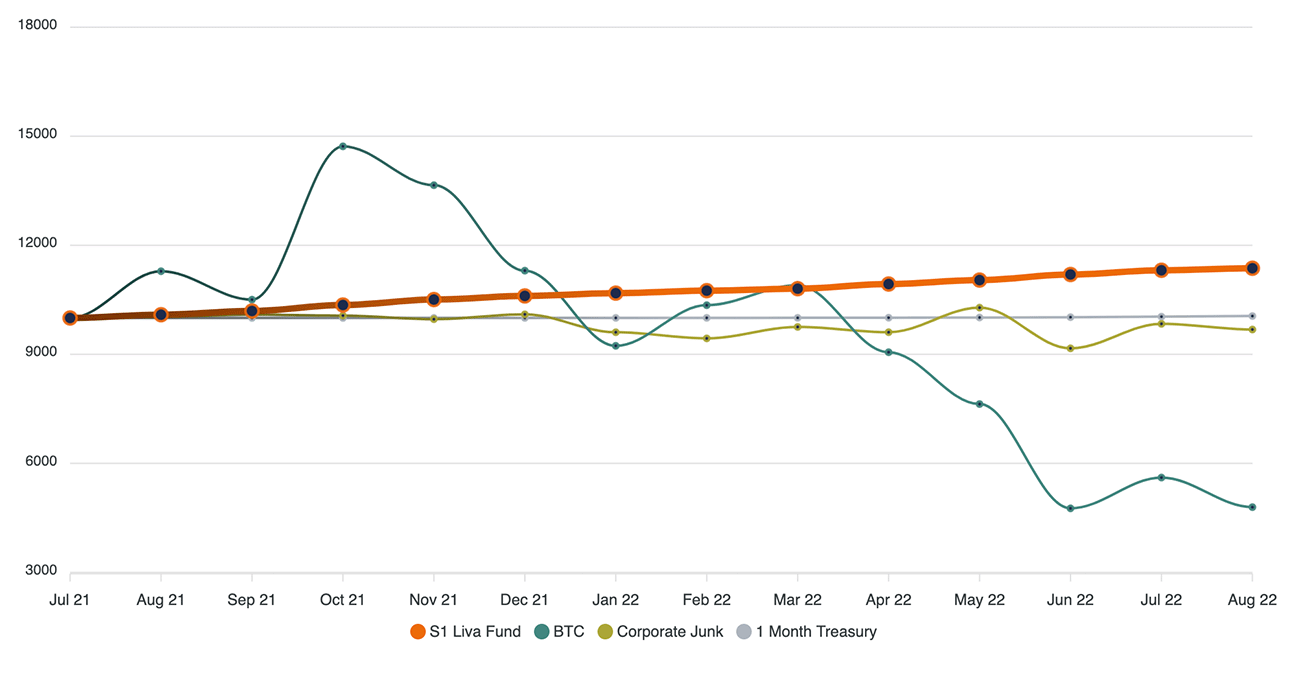

Invest in DeFi in a managed, secure and compliant way and earn S&P 500 comparable returns with very low risk

Please fill out form below to receive our Factsheet and Offering Memorandum

What is the LIVA fund?

The LIVA fund is a Bahamas Securities Commission registered fund that invests in DeFi Products. The purpose of the fund is to provide liquid, secure, and stable investment returns over time on behalf of professional (i.e. institutional and qualified) investors, who seek portfolio exposure to yield producing digital asset vaults in DeFi.

Uniquely, the LIVA fund is a DeFi fund managed by proprietary AI (Artificial Intelligence) driven algorithms targeted at investors more comfortable with traditional investments.

Objective of LIVA fund

- Stable, predictable returns between 15-25% with no or minimal risk to the principal

- Market neutral strategy

- Build a portfolio with the most attractive Risk/Reward Ratio in the DeFi Space

- Investment process for crypto products that is familiar to traditional investors

- No need to convert from fiat to crypto and vice versa by utilizing stable coins

- Fast time to market – average three months or less compared to building a solution, which would take a minimum of one year

Conditions

- Accuracy

- ensure that we have accurate and auditable NAV (Net Asset Value) calculations

- Secure system protecting from misuse and hacking

- access controls – being able to control who is able to invest and withdraw from the fund

- System of checks and balances with multiple authentications ensuring that no single entity can access and manipulate algorithms, steal, or misuse user data

Challenges Addressed

- There is no single viable protocol in DeFi that reliably produces 15 – 25% returns, which means that in order to achieve that goal we needed to stack returns of different protocols.

- Fast-moving 24/7 market requires active 24/7 monitoring.

- Avoid extreme volatility of many crypto assets whereby protecting principal.

- Complexity of the integration of different underlying protocols – complexity drives cost and risk.

- The ultra-short lifecycle of the products we invest in requires constant maintenance and development of protocol integrations.

- Development cost of building the platform is prohibitive.

- Finding the talent in this space is difficult – there are a limited number of experts in this space.

Strategy

To earn S&P comparable returns with lower risk and no beta (volatility) exposure, using the Yieldster DeFi Technology Platform and an autonomous, proprietary artificial intelligence (AI) algorithm to deploy liquidity across over-collateralized stable-coin lending and yield farming protocols in the DeFi space.

Asset Selection

- Stable Coins and approved core assets (ETH/BTC)

- Must be at least 6 months old and must have maintained peg for at least 6 months

- Must have sufficient liquidity (investment size <5% of available liquidity)

Protocol & Digital asset vault selection

- Insurance available on NexusMutual for <5% annual premium

- Investment exposure in any pool is limited to a maximum of 5% of its total assets

- At least 6 months in existence

- Low risk of impermanent loss risk

- Exchange rates must be hedge-able

Distribution

Fund Manager

seriesOne Capital (Bahamas) Ltd.

contact@livafund.com

Facts

Fees

Service Providers

Not available to U.S. Investors

Steps to invest

Steps to invest in the seriesOne LIVA Fund:

- Offering memorandum signed and account open at Weiser Capital Bahamas

- FIAT is transferred to Weiser Capital

- Weiser Capital converts FIAT to crypto by purchasing USDC

- USDC is then sent to a multi signature wallet (Gnosis or Meta Mask)

- The USDC is sent from the multi signature wallet to a Yieldster vault

- The multi signature wallet then receive their share of the Yieldster vault in the form of tokens

- The tokens are once again held in the multi signature wallet

-

The Yieldster vault deposits the USDC in AAVE (A lending protocol)

- A borrower will deposit 1 ETH or $4000 worth of Ethereum to borrow $2000 USDC

- Yieldster will hold on the 1 ETH

- Yieldster will charge interest on the $2000 borrowed

-

Two options to undo the transactions:

- The borrower pays back the $2000 and receives back ETH

- The price of ETH drops to $3000. Yieldster will sell the 1 ETH, hold on to the $2000 + fees and give back the remaining to the borrower

- When Yieldster deposits USDC into AAVE it receives back a coupon representing its loan

- The coupon is then deposited a market making pool to provide liquidity for buy/sell the coupon

- The market making pool will receive trading fees in exchange for providing liquidity for the coupon

- When depositing in a market making pool, you receive back a token representing your share of the market making pool

- The market making share is then deposited in a staking safe where the share is locked up for a period of time and in exchange receives a greater share of the fees

- The process of Step 8 and onward is repeated with different protocols and lending pools, hence stacking the yields and all governed by smart contract and Yieldster proprietary algorithm deployed by seriesOne LIVA Fund

Contact

Please don't hesitate to contact us:

seriesOne Capital (Bahamas) Ltd.

contact@livafund.com

Disclaimer - The information contained in this document is intended for general information only and in no circumstance should be construed as a solicitation or the provision of investment or other professional advice on the part of seriesOne Capital Ltd., their present or future subsidiaries or affiliates (“seriesOne”). This material does not replace indepen- dent professional advice. seriesOne makes no representation or warranty of accuracy, express or implied, of any kind and has no obligation or responsibility in respect of any errors or omissions which may occur. seriesOne shall have no liability for any loss or damage arising out of the use or reliance on the information provided including without limitation, any loss of profits or any other damage, direct or consequential to an investor or otherwise. No information on this document constitutes investment, tax, legal or any other advice. All investments in funds are subject to market risks. The value of units may go up or down based on market conditions. Past performance should not be taken as an indication or guarantee of future performance and no representation or warranty, express or implied, is made regarding future performance. This literature is issued for information purposes only and investors should make their own appraisal of the investment opportunity and consult their own financial, legal and other professional advisors prior to making any subscrip- tions. Investors should read all relevant documentation, including but not limited to the Offering Memorandum of a fund carefully to understand the investment policy and risks involved. seriesOne makes no guarantee for return and/or original investment. seriesOne does not accept any liability in this regard. Prospective investors should consult their own professional advisers on the tax implications of making an investment in, holding or disposing of any of the funds under management of seriesOne and the receipt of distributions with respect to such a fund. If an investor has any doubt as to the appropriate course of action, seriesOne recommends that such investor consult their own independent financial adviser, stockbroker, lawyer, accountant or other professional adviser. An application for any investment referred to in this document may only be made on the basis of the offering document, prospectus or other applicable terms relating to the specific investment. The information contained in this document does not constitute an offer to buy and sell shares/ units in any of the funds under management of seriesOne, nor is the information directed at any jurisdiction in which the offer, sale or recommendation is not authorized. This document is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this document is prohibited. Persons in respect of whom such prohibitions apply must not access this document. seriesOne disclaims all warranties, expressed or implied, including but not limited to implied warranties and conditions of merchantability, fitness for a particular purpose, title and non-infringement. It is the responsibility of an investor or prospective investor to evaluate the accuracy, completeness and usefulness of any options, advice, services or other information provided. All information contained on any section of this document is distributed with the understanding that seriesOne is not rendering legal, accounting or other professional advice or opinions on specific facts or matters and accordingly assume no liability whatsoever in connection with its use. Any prospective investor should consult their own legal or tax advisor or financial advisor with respect to its personal situation. In no event shall seriesOne be liable for any direct, special, incidental or consequential damages arising out of the use of the information herein.